Minakshi Ghosh (Class of 2021)

The Rise of Neo/Challenger Banks, in the “Digital-First” Banking Era

Imagine when your banking needs were a day’s job. From the opening of a bank account to any transaction needed, you would stand in queues, run for documents, and plan for days in advance. Banks did not consider customers’ needs the central focus for forming policies, resulting in low satisfaction. Other key characteristics of this traditional banking age included:

- High OPEX pressure

- Unbanked SME segment

- Standardised products

Then came the era of smartphones and applications! Consumers were now exposed to a one stop solution for their challenges and these applications made banking an efficient and easy activity for customers. The utility of applications was also amplified by the FinTechs and the Bigt Tchs (GAAFA and BAT), with their data driven solutions.

FinTechs had increasingly challenged the incumbents by providing niche products for challenges faced by consumers. Big Techs like Amazon and Alibaba brought about changes in the way personalisation and experience were offered. Consecutively, Facebook and Google showed how data could be used to offer and provide specific solutions.

Innovation and technology have become key drivers for the banking industry’s growth and transformation. This transformation resulted in the inclusion of new players in the value chain. Technology providers infiltrated the industry with infrastructural strength and innovative business approaches. Customers, especially millennials, now demand new and enhanced propositions from banking.

The Resultant New-Age Banking

Result is the introduction of neo/challenger banks. Neo/Challenger banks, by using technology, solve challenges of the banking industry and provide solutions to the changing needs of the customers. Neo/Challenger banks are “digital-only” banks, whose primary value proposition is making banking simple, convenient and meaningful.

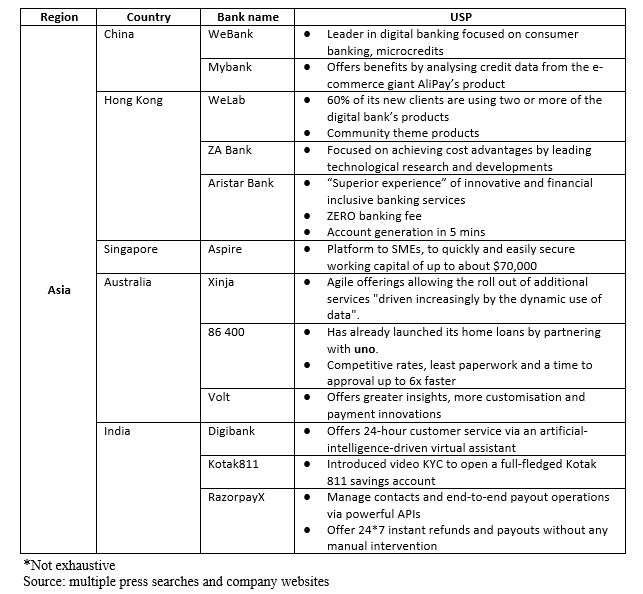

Globally, the leaders in neo/virtual banks are China, Hong Kong, Singapore, South Korea, Australia, and India from Asia Pacific, UK and Germany from Europe, and the US. Every region and country has incorporated and licensed many neobanks and the associated regulations for them.

In the UK, Monzo and Revolut are the forerunners, along with Moven bank, Simple, and Gobank leading the pack in the US. Asia Pacific has been an interesting market for the neobanking space. With 2019 and 2020 bringing the launch of new neobanks amidst uncertainties. Focus on SMEs, better interest rates and superior experience are some key USPs of these players.

New-Age Banks and Their Survival Kit!

COVID-19 has had a dual effect on these new-age banks. On the one hand, it has pushed an increasing number of consumers to online channels. In its first week of interception in July 2020, WeLab saw a registration of 10,000 consumers in the first 10 days[1]. Yet, the advantageous products that neobanks offer are now facing challenges. In addition, the incumbent banks have also responded to the pressures of digitisation by accelerating their pace of incorporating digital only services. This has added to the challenges to the success of the neobanks.

A neobank’s primary value proposition lies in providing an unparalleled “experience,” along with passing on benefits realised from low OPEX. Yet, there are two primary challenges which the neobanks face:

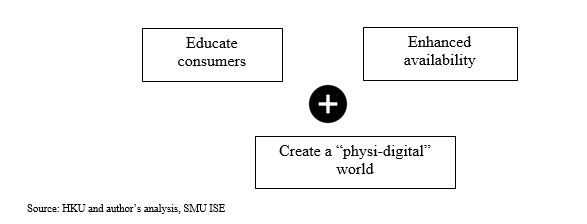

- “Digital-only” presence: the primary concept of a neobank is to provide “digital-only” banking experience. A recent survey by SMU ISE, revealed that >40% of Singapore’s present retail banking customers are willing to accept digital only banks. Yet, many consumers are not willing to rely on banks which do not have a physical presence. Virtual banks will need to follow a three step success approach to diminish this concern.

- High customer acquisition cost: neobanks are attracting potential customers through value-adds and enhanced interest rates. The cost is also heightened by a smaller customer base and limited number of products. Once neobanks are able to achieve a larger customer base, they will become a challenge to the incumbents. To sustain and win, neobanks will have to focus on limiting this cost to enjoy the efficiencies of operations and technology they plan to achieve.

Conclusion

The coming two to three years will be a test for the neo/challenger banks. Rising digital savvy customers, focused services, and hyper-experience are primary drivers. We will also witness a rise in the inclusion of SMEs in the customer list of challenger banks. With successful penetration by banking the retail and SMEs, fast moving consumers will determine the viability of these new-age challenger banks.

[1] Virtual Banking in Hong Kong: How it Paved the Way for Asia

Pre-MBA Industry: Research

Company: Twimbit

Job Title: Research Manager